How Much Can You Afford? Calculating Your First Home Budget the Right Way

How Much Can You Afford? Calculating Your First Home Budget the Right Way

Purchasing your first home is a thrilling milestone, but it also comes with one of the biggest financial decisions you’ll ever make: determining how much you can afford. Many first-time buyers focus only on the listing price of homes, overlooking key expenses like closing costs, property taxes, maintenance, and insurance. The result? A budget that feels stretched too thin after moving in.

This guide offers a detailed roadmap to calculating your first home budget. You’ll learn about key financial factors, practical examples, and the role of technology in simplifying the process. By the end, you’ll feel confident in setting a realistic budget that allows you to enjoy homeownership without financial stress.

Young Couple Reviewing Home Budget Plans

Relevance: This image illustrates the importance of sitting down to evaluate finances before making the leap into homeownership.

Why Budgeting for Your First Home Matters

Budgeting isn’t just about figuring out how much you can borrow from a bank. It’s about ensuring long-term financial stability while still leaving room for other life goals such as travel, education, or starting a family.

Failing to budget properly can result in unexpected stress, high debt, and in worst cases, foreclosure. By carefully calculating your budget, you’ll not only avoid common mistakes but also gain the peace of mind that comes with knowing your home truly fits your financial reality.

Key Factors in Calculating Your First Home Budget

Income and Debt-to-Income Ratio

Your income is the foundation of your home budget. Lenders typically look at your debt-to-income (DTI) ratio, which compares your monthly debts to your gross monthly income. A lower DTI shows that you can manage mortgage payments comfortably.

Understanding this ratio also helps you set realistic boundaries. Even if you’re approved for a higher loan amount, sticking to a budget that keeps your DTI in a safe range ensures financial flexibility.

Down Payment Considerations

Your down payment is a crucial factor in affordability. A larger down payment reduces your monthly mortgage payment and may eliminate the need for private mortgage insurance (PMI).

First-time buyers should plan for not just the minimum required down payment but also aim to set aside extra for emergencies. This ensures that purchasing a home doesn’t wipe out your savings entirely.

Hidden and Ongoing Costs

Beyond your mortgage, owning a home comes with ongoing expenses: property taxes, homeowner’s insurance, HOA fees, and maintenance. These costs often surprise first-time buyers.

Including them in your budget prevents financial strain. For example, even modest maintenance—like roof repairs, plumbing, or repainting—can add up quickly over the years.

Lifestyle and Future Goals

Your budget should also account for personal goals. If you plan to have children, pursue higher education, or start a business, buying at the top of your budget may not leave enough financial flexibility.

Balancing your home purchase with your lifestyle ensures that your dream home doesn’t become a financial burden.

Online Budgeting Tool Displaying Mortgage Breakdown

Relevance: Digital tools provide visual breakdowns of mortgage payments, taxes, and insurance, helping first-time buyers see the complete picture.

Real-World Examples of Tools and Services

Mortgage Affordability Calculators

Mortgage calculators allow you to estimate monthly payments by inputting your income, down payment, and loan terms. They provide a snapshot of affordability before you begin house hunting.

Relevance: These tools help avoid disappointment by setting clear expectations of what price range you can realistically consider.

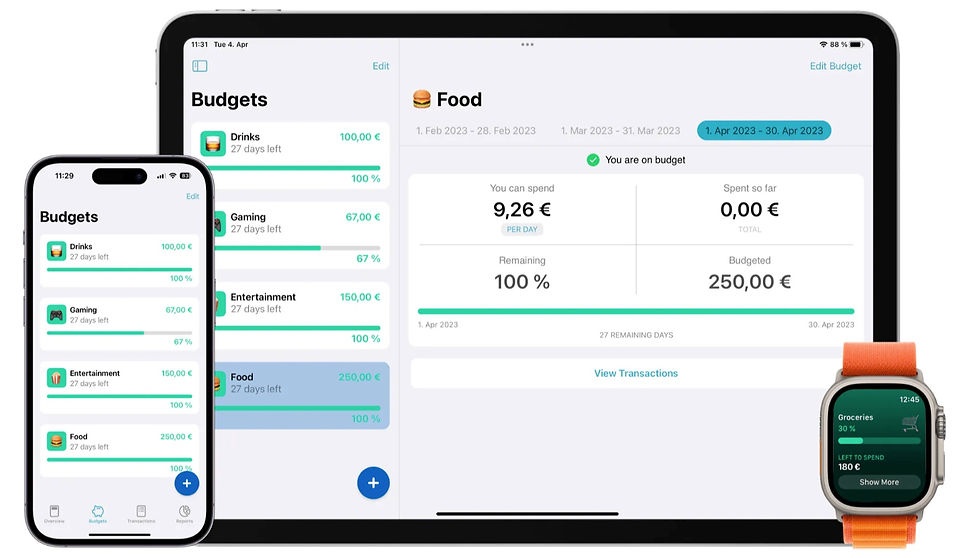

Budgeting Apps for Homebuyers

Modern budgeting apps track income, spending, and savings goals in real-time. They allow first-time buyers to allocate funds toward a down payment without disrupting daily expenses.

Relevance: By monitoring spending habits, buyers can identify areas to cut back and increase savings for their first home.

Credit Monitoring Platforms

Your credit score directly affects mortgage rates. Credit monitoring platforms alert you to changes and suggest improvements before you apply for a loan.

Relevance: A higher credit score can save buyers thousands in interest over the life of the loan.

Financial Planning Services

Some financial advisors offer first-time buyer programs that create tailored budgets. These services analyze not just your income, but also your long-term financial goals.

Relevance: They ensure that buying your first home aligns with your broader life plans.

Benefits of Using Technology in Budgeting

Technology has revolutionized financial planning for first-time buyers. Instead of manually calculating payments or guessing costs, buyers can now access tools that provide instant insights.

These platforms increase transparency, reduce mistakes, and speed up decision-making. For first-time buyers who may already feel overwhelmed, technology ensures clarity and confidence in every step of the process.

Practical Use Cases

-

Single Professionals: Can use budgeting apps to balance mortgage payments with student loans or travel goals.

-

Young Couples: Benefit from affordability calculators that factor in combined incomes and potential childcare expenses.

-

Families: Use financial planning services to ensure long-term stability while preparing for children’s education costs.

-

Low-Income Buyers: Rely on credit monitoring apps to improve scores and qualify for better mortgage rates.

Couple Meeting a Financial Advisor Online

Relevance: Virtual consultations allow buyers to receive expert advice without taking time away from work or family obligations.

Frequently Asked Questions

1. How do I know what percentage of my income should go toward housing?

Most experts recommend spending no more than 28–30% of your gross monthly income on housing. This ensures you can still cover other debts and personal expenses comfortably.

2. Should I buy at the maximum amount my lender approves?

Not necessarily. Lenders may approve you for more than you can realistically afford. It’s smarter to buy below your maximum limit so you maintain financial flexibility.

3. What hidden costs should I include in my home budget?

In addition to your mortgage, include property taxes, homeowner’s insurance, maintenance, utilities, and possible HOA fees. These can significantly impact your monthly budget.