Common Mistakes First-Time Homebuyers Make (and How to Avoid Them)

Common Mistakes First-Time Homebuyers Make (and How to Avoid Them)

Buying a home for the first time is an exciting yet challenging experience. For many, it represents the biggest financial commitment of their lives, but without preparation, it’s easy to make costly mistakes. From underestimating hidden costs to neglecting home inspections, first-time buyers often learn lessons the hard way.

This detailed guide explores the most common mistakes first-time homebuyers make and offers proven strategies to avoid them. You’ll also discover how technology and modern tools can simplify the process, plus real-world examples of where buyers went wrong and how smarter decisions could have saved them time, money, and stress.

A Young Couple Reviewing Home Listings Online

This image highlights the very beginning of the homebuying journey, where enthusiasm often meets inexperience.

Relevance: It illustrates how first-time buyers often dive into searching without a clear strategy or understanding of financial readiness.

Mistake 1: Skipping Financial Preparation

One of the biggest mistakes first-time buyers make is underestimating how much money is needed beyond the down payment. Costs like closing fees, property taxes, insurance, and ongoing maintenance are often overlooked.

Without a clear budget, many buyers find themselves house-poor—owning a home but struggling to cover other expenses. The best way to avoid this is to create a comprehensive budget and build in a financial buffer for unexpected costs.

Mistake 2: Not Getting Pre-Approved Early

Excitement often drives first-time buyers straight to house hunting without securing a mortgage pre-approval. This mistake leads to wasted time looking at homes outside their price range.

Pre-approval not only clarifies your budget but also shows sellers you’re a serious buyer. In competitive markets, this can be the difference between winning or losing a bid. Avoiding this mistake means starting with your lender before calling your realtor.

Mistake 3: Overlooking Location Priorities

Many first-time homebuyers get swayed by the charm of a property and overlook critical factors like commute times, neighborhood safety, or school districts. A beautiful home in the wrong location can lead to regret.

The key is to balance lifestyle needs with long-term investment value. Researching neighborhoods, visiting at different times of day, and considering future resale potential helps buyers make more informed decisions.

Mistake 4: Letting Emotions Take Over

Falling in love with a home is common, but emotional decision-making can lead buyers to overpay or ignore flaws. Sellers and agents can sense desperation, weakening your negotiation power.

To avoid this, approach the process with a balance of excitement and logic. Work with an agent who can provide objective advice and remind you of your priorities when emotions run high.

First-Time Buyer Talking with a Real Estate Agent

This represents the support system buyers need to stay objective and avoid impulsive choices.

Relevance: Agents guide buyers away from emotionally driven mistakes by offering professional insights.

Mistake 5: Waiving the Home Inspection

In competitive markets, some buyers skip inspections to make their offer more appealing. This can be disastrous if the property has hidden issues like foundation problems, plumbing leaks, or electrical hazards.

A home inspection is your safeguard against costly surprises. Even if you’re eager to close quickly, never forgo this step. Instead, be prepared to renegotiate if major issues arise.

Mistake 6: Ignoring Long-Term Costs

First-time buyers often focus only on the purchase price, forgetting ongoing expenses such as property taxes, HOA fees, energy bills, and maintenance. These can quickly add up and stretch budgets thin.

By calculating total cost of ownership instead of just mortgage payments, buyers can ensure long-term financial comfort. Tools like online affordability calculators can help plan realistically.

Mistake 7: Not Exploring First-Time Buyer Programs

Government-backed loans, grants, and first-time homebuyer assistance programs are often overlooked. These can reduce down payment requirements and save thousands in upfront costs.

Skipping research on these programs is a missed opportunity. Buyers should always explore federal, state, or local options available to them before committing to a loan.

Mistake 8: Forgetting About Resale Value

It’s easy to focus on the present when buying your first home, but ignoring future resale potential can hurt long-term financial goals. A home with unique or quirky features may be hard to sell later.

First-time buyers should think of their first home not just as a living space, but as an investment. Choosing a property with broad appeal and growth potential in its location ensures stronger resale value.

Real-World Examples of Tools That Help Buyers Avoid Mistakes

Mortgage Pre-Approval Apps

Digital mortgage apps allow buyers to get pre-approved online, saving time and setting realistic expectations.

Relevance: These tools prevent buyers from shopping outside their budget, a common first-time mistake.

Virtual House Tour Platforms

3D and virtual tours give buyers a realistic sense of space without rushing into an in-person decision.

Relevance: They help buyers evaluate multiple options before falling in love with a property prematurely.

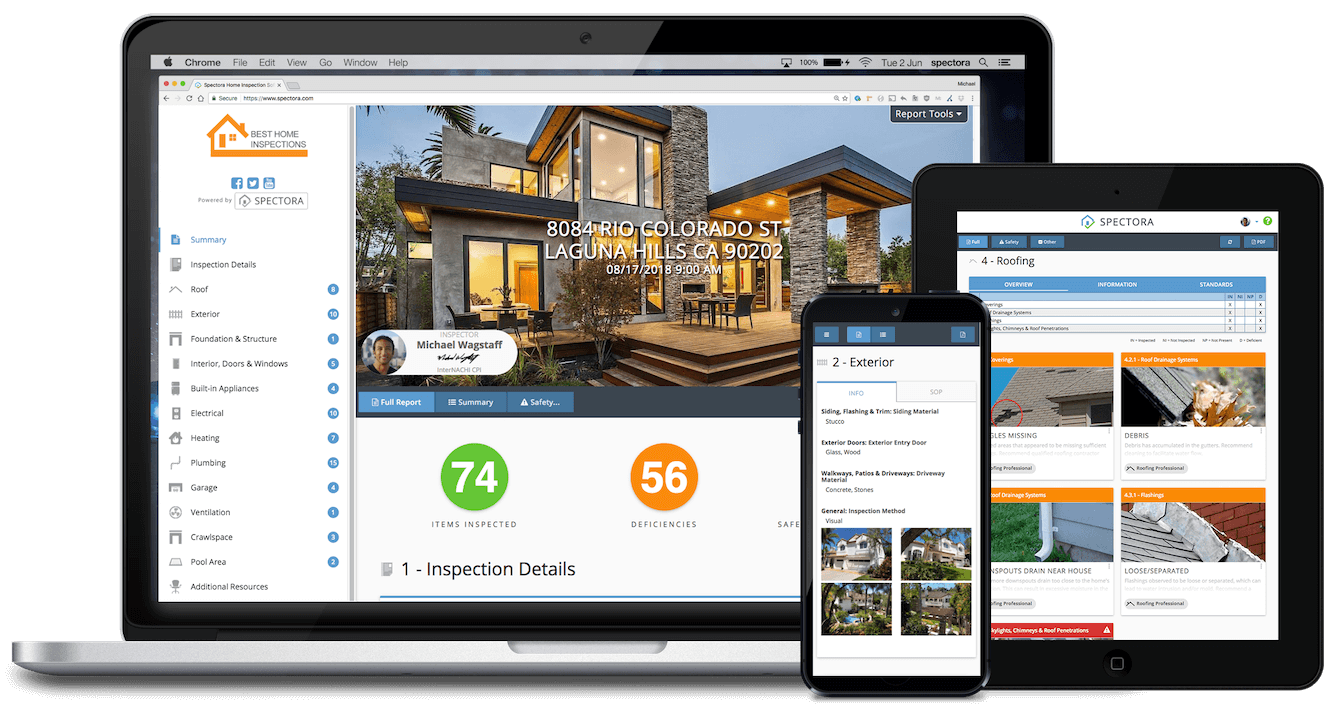

Home Inspection Software

Some inspectors now provide digital reports with photos and recommendations.

Relevance: These tools make inspection findings clear and actionable, reducing the risk of overlooking critical issues.

Benefits of Using Technology to Avoid Mistakes

Modern technology has revolutionized the homebuying process, especially for first-time buyers. Digital tools save time, increase transparency, and provide buyers with resources to make smarter decisions.

Mortgage calculators prevent financial missteps, virtual tours reduce emotional bias, and inspection software ensures no detail is missed. By embracing these tools, buyers gain confidence and reduce the chances of making expensive mistakes.

Practical Use Cases

-

Young Professionals: Using apps for budgeting and pre-approval ensures they don’t waste time on unaffordable properties.

-

Families with Kids: Neighborhood research tools help them avoid buying in areas that don’t fit their lifestyle needs.

-

Relocating Buyers: Virtual tours let them narrow choices before making travel arrangements.

-

Budget-Conscious Buyers: Access to grants and loan calculators prevents them from being financially overextended.

Frequently Asked Questions

1. What is the biggest mistake first-time homebuyers make?

The most common mistake is underestimating the full cost of homeownership. Many focus only on the down payment and mortgage, forgetting about taxes, insurance, and maintenance.

2. Is it okay to buy a home without an inspection?

No. Skipping an inspection may seem like a shortcut, but it exposes you to major financial risks if hidden issues exist. Always invest in a professional inspection.

3. How can first-time buyers avoid overpaying for a home?

By getting pre-approved, working with a real estate agent, and comparing similar properties in the area, buyers can make competitive but fair offers without overspending.