How to Save for a Down Payment Faster: Smart Strategies for First-Time Buyers

How to Save for a Down Payment Faster: Smart Strategies for First-Time Buyers

Buying your first home is a major milestone, but the biggest challenge for many is saving enough for the down payment. While it can feel overwhelming, there are proven strategies, tools, and mindset shifts that can help you build your savings more efficiently. This guide explores practical methods, real-world examples, and smart uses of technology to help you reach your goal faster.

Why Saving for a Down Payment Feels Challenging

For first-time buyers, a down payment often seems like an insurmountable hurdle. Rising property prices, everyday expenses, and debt obligations make saving difficult. However, with proper planning and consistent effort, even modest contributions can grow into a substantial fund over time. Understanding the barriers—such as lifestyle inflation, unexpected costs, or poor budgeting habits—is the first step to overcoming them.

Setting a Realistic Down Payment Goal

Understanding Typical Down Payment Requirements

The amount needed for a down payment depends on the type of mortgage, the price of the property, and your financial situation. Many buyers aim for the traditional 20% down, but in reality, some loan programs allow for much less. Even so, the larger the down payment, the better your terms and monthly payments will be.

A clear target motivates you to save faster. Instead of vaguely saying you want “a house someday,” calculate a specific number—whether that’s $25,000, $40,000, or more. Having a tangible goal creates focus and accountability.

Breaking Down the Numbers

Once you know your target, break it into smaller milestones. For example, if you need $30,000 in three years, that means saving $10,000 a year or about $833 a month. Smaller, actionable figures help you see the progress and stay motivated, while also showing you what adjustments are necessary in your budget.

Building a Budget That Works

Tracking Every Dollar

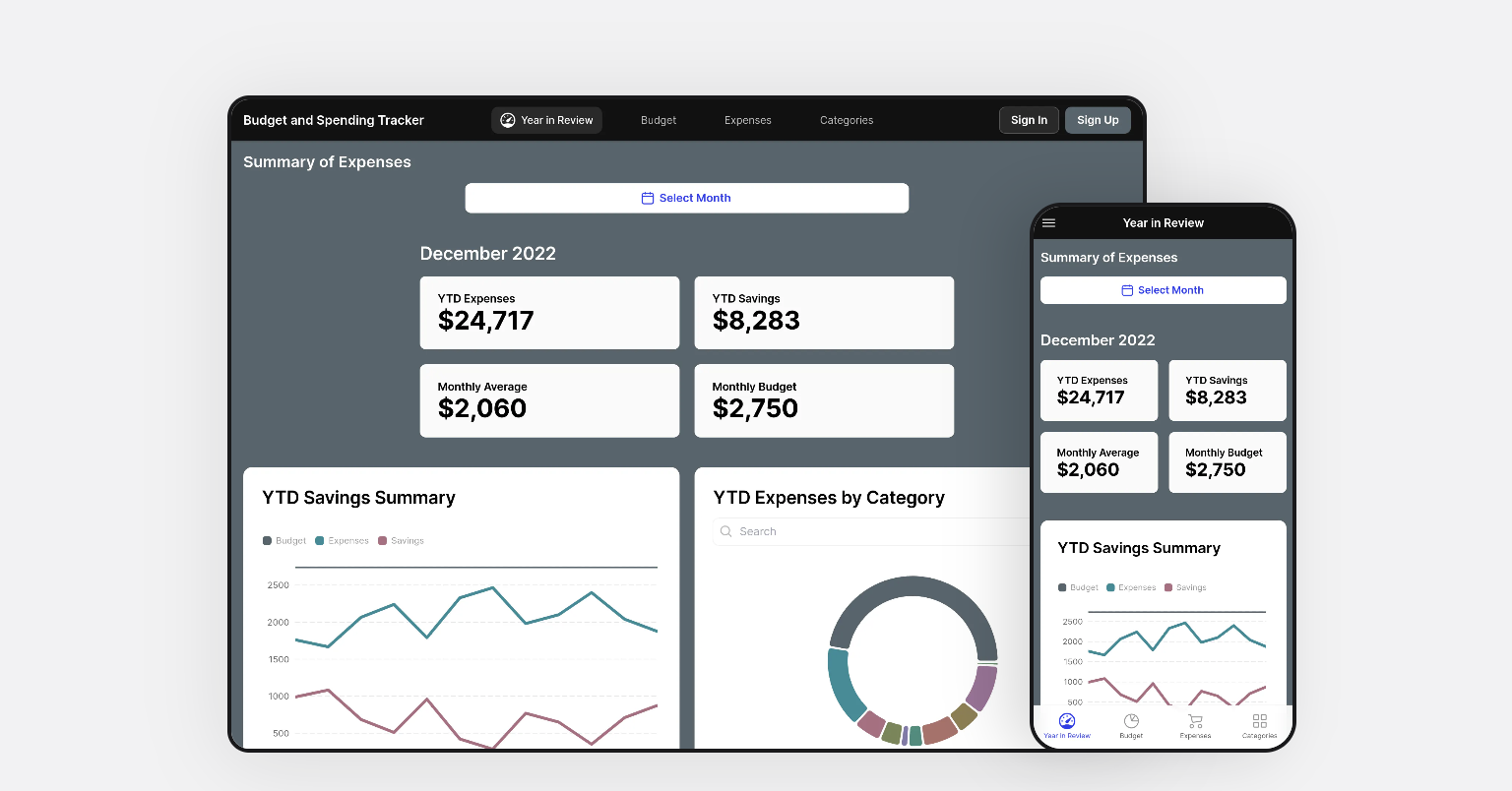

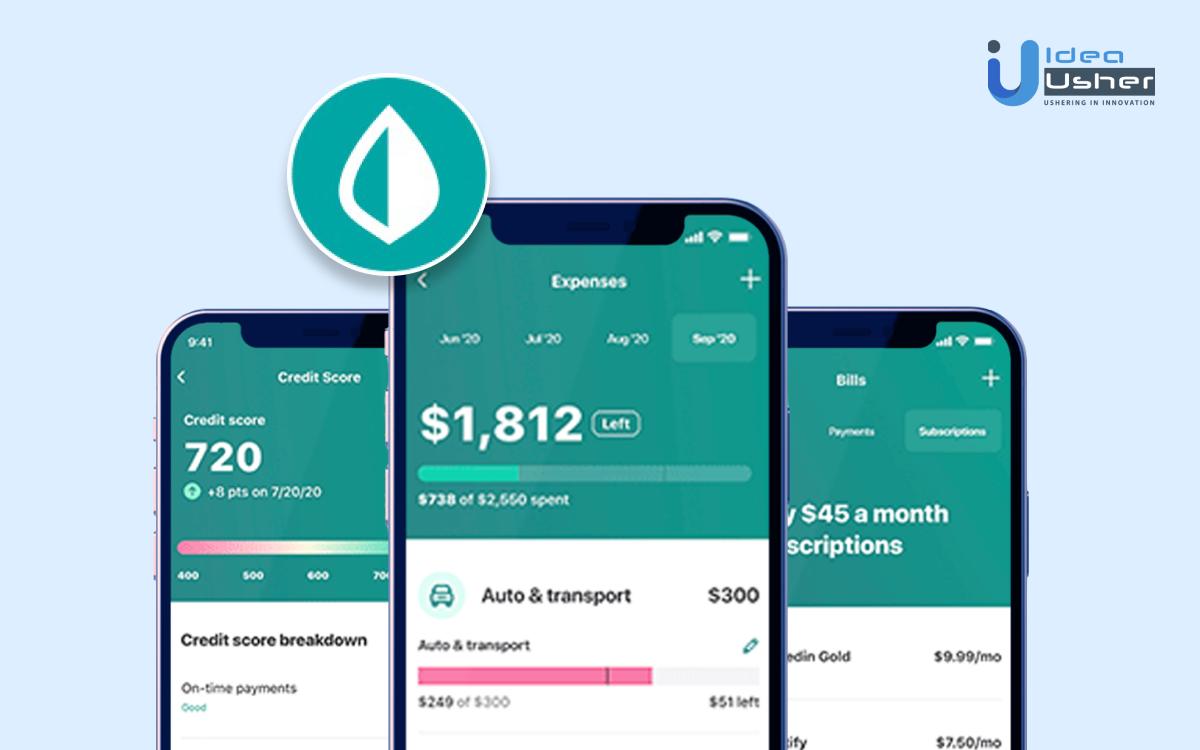

Budgeting is the foundation of saving for a down payment. Start by tracking every dollar you earn and spend. Apps like Mint, YNAB (You Need a Budget), or even a detailed spreadsheet can provide clarity. By knowing exactly where your money goes, you can find hidden opportunities to cut costs and redirect funds into your savings.

Identifying Spending Leaks

Many people underestimate how much small expenses add up. Coffee runs, dining out, or impulse online shopping might seem harmless but can amount to thousands a year. Eliminating or reducing these “spending leaks” creates immediate room in your budget for your down payment fund.

Using Technology to Boost Savings

Automated Transfers

One of the simplest ways to save faster is by automating transfers. Many banks and apps allow you to schedule automatic deposits into a dedicated savings account. By treating savings like a recurring bill, you ensure consistency without relying on willpower.

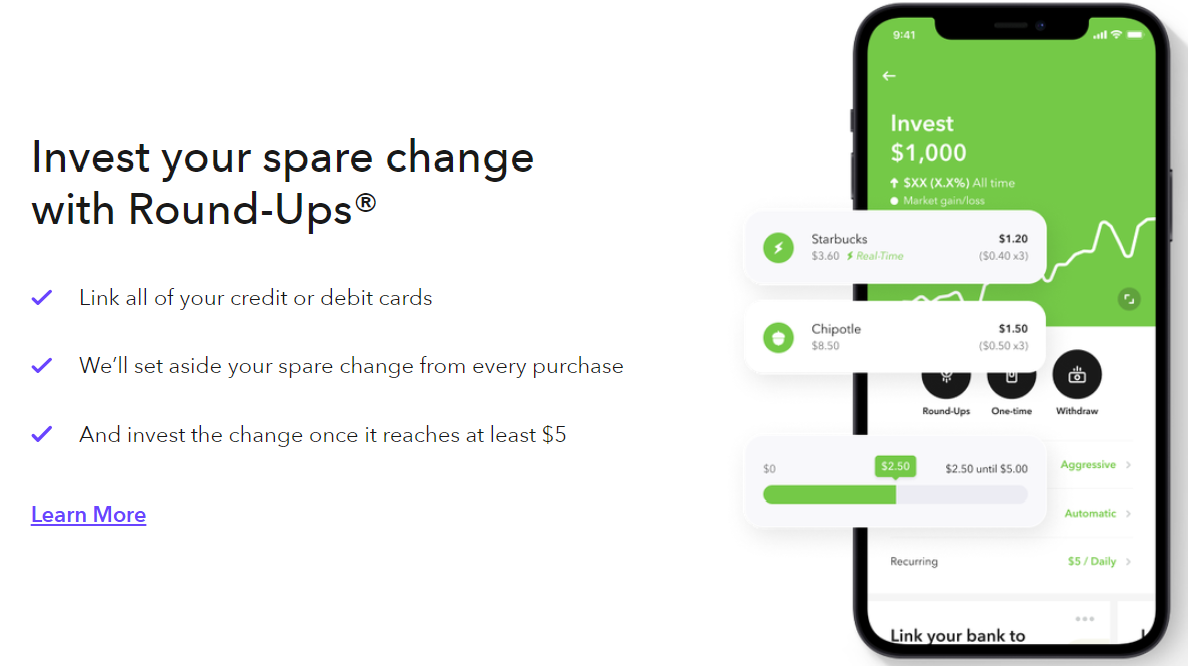

Round-Up Apps

Tools like Acorns or Qapital round up your daily purchases and invest or save the difference. For example, a $4.50 coffee would round up to $5, with $0.50 automatically transferred. Over time, these micro-savings add up without you noticing, accelerating your down payment fund.

Real-World Examples of Smart Saving Tools

Mint for Budgeting Clarity

Mint helps users connect all their bank accounts, credit cards, and loans in one place. For aspiring homeowners, this clarity highlights unnecessary expenses and helps create a personalized savings plan. By tracking every transaction, it reveals patterns that can be adjusted to prioritize down payment savings.

YNAB for Goal-Oriented Planning

YNAB takes budgeting further by encouraging you to “give every dollar a job.” For someone saving for a down payment, you can set your savings goal as a priority, ensuring all spending decisions align with that target. Its proactive style builds financial discipline and reduces the temptation of overspending.

Acorns for Micro-Saving

Acorns is designed for people who struggle to save big chunks of money. By investing spare change automatically, it grows a fund passively. While not a substitute for direct savings, it provides an extra boost for your down payment over time.

Practical Lifestyle Adjustments

Downsizing Expenses

Sometimes saving requires bigger lifestyle shifts, such as moving into a smaller rental, cutting subscription services, or reducing car-related expenses. While these changes may feel like sacrifices, they are temporary trade-offs that speed up your journey to homeownership.

Earning Extra Income

Side hustles, freelance gigs, or even selling unused items can significantly accelerate your savings. Dedicating any extra income exclusively to your down payment fund ensures faster progress without affecting your current lifestyle too much.

Benefits of a Dedicated Savings Account

A dedicated high-yield savings account for your down payment offers multiple benefits. First, it separates the money from your everyday spending, reducing temptation. Second, it often provides better interest rates than a regular account, allowing your money to grow passively. Third, the psychological effect of watching your balance increase provides motivation to stay consistent.

Real-Life Use Cases

-

Young Professional Couple – By automating transfers of $500 monthly into a separate savings account and cutting back on vacations, they saved $18,000 in three years for a starter condo.

-

Single Buyer with Side Hustle – A teacher started tutoring online twice a week, earning an extra $400 a month. Over two years, she saved $9,600 solely from her side income, accelerating her path to homeownership.

-

Family with Kids – By switching to a smaller rental and canceling non-essential subscriptions, a family freed up $700 monthly. Within four years, they saved over $30,000, enough for a comfortable down payment.

Why Technology Makes a Difference

Technology simplifies financial management by automating tasks and creating transparency. Without tools like budgeting apps, it’s easy to lose track of spending and miss savings opportunities. Automated transfers and round-ups reduce human error and inconsistency, making it easier to stick to long-term financial goals.

Frequently Asked Questions

1. How long does it usually take to save for a down payment?

It varies widely depending on income, expenses, and home prices in your area. On average, it may take 3–7 years, but using aggressive saving strategies and side income can significantly shorten the timeline.

2. Should I invest my savings or keep them in cash?

For short-term goals like a down payment within five years, it’s generally safer to keep funds in a high-yield savings account or a low-risk option. Investing in stocks may yield higher returns but also carries risk of loss, which could delay your purchase.

3. How much of my income should I save each month for a down payment?

A common rule of thumb is at least 20% of your income if possible. However, the exact amount depends on your target goal, timeline, and other financial obligations. Even smaller percentages can add up if saved consistently.