The Complete Checklist for First-Time Homebuyers: Step-by-Step Guide to a Smooth Purchase

The Complete Checklist for First-Time Homebuyers: Step-by-Step Guide to a Smooth Purchase

Buying your first home is an exciting milestone, but it can also feel overwhelming without the right roadmap. From financial preparation to final closing, there are many steps first-time buyers need to take. Missing one detail could delay your purchase or create unnecessary stress. That’s why having a complete checklist is essential.

This guide provides an in-depth first-time homebuyer checklist. It covers financial readiness, mortgage options, property search strategies, inspections, and closing processes. With practical examples, technology tools, and expert insights, you’ll be well-prepared to navigate your homebuying journey with confidence.

Couple Reviewing a Homebuyer Checklist on a Tablet

Relevance: Highlights the value of organizing your steps digitally before beginning the buying process.

Financial Preparation: The Foundation of Your Checklist

Evaluate Your Budget and Savings

Before you start browsing listings, you need a clear understanding of your financial position. This means calculating how much you can afford for a down payment, monthly mortgage, and additional costs like property taxes and insurance.

It’s recommended to keep housing expenses within 28–30% of your gross monthly income. Budgeting apps and affordability calculators can provide clarity on how much you should reasonably spend.

Review Your Credit Score

Your credit score plays a major role in determining your mortgage eligibility and interest rate. A higher score could save you thousands over the life of your loan. Monitoring your credit early allows you to address issues like high balances or late payments before applying.

Using credit monitoring platforms ensures you’re alerted to changes and gives you time to boost your score before you start the mortgage process.

Online Mortgage Pre-Approval Form

Relevance: Pre-approval gives buyers a clear understanding of their budget and strengthens their offers when negotiating.

Securing Mortgage Pre-Approval

Understand Mortgage Types

First-time buyers often get confused by the variety of mortgage options available. Fixed-rate, adjustable-rate, government-backed loans, and conventional mortgages all have different terms and benefits.

Choosing the right type depends on your financial stability, how long you plan to stay in the home, and your tolerance for risk. Researching these options ahead of time avoids surprises later.

Importance of Pre-Approval

Getting pre-approved for a mortgage is a critical step on your checklist. It shows sellers you’re serious and capable of financing the purchase. Pre-approval also helps you avoid falling in love with homes that are outside your financial reach.

Having this letter in hand before starting your search can make the difference between winning or losing a bid in competitive markets.

Finding the Right Property

Define Your Needs and Wants

One of the biggest mistakes first-time buyers make is not separating their needs from their wants. Essential needs might include the number of bedrooms, proximity to work, or school districts, while wants may include upgraded kitchens or larger backyards.

Creating a prioritized list helps narrow down options and makes the house-hunting process less overwhelming.

Work with a Real Estate Agent

An experienced agent guides you through the entire process, from finding listings to negotiating offers. They can also provide insider knowledge on neighborhoods, local pricing trends, and red flags to watch out for.

While it may feel tempting to search alone, having a trusted professional on your side reduces risks and saves time.

Home Inspector Examining a Property

Relevance: Home inspections reveal hidden issues that could impact long-term costs and safety.

Home Inspections and Appraisals

Why Inspections Are Crucial

A home inspection ensures that the property you’re purchasing is structurally sound and free from major issues. Inspectors look at electrical systems, plumbing, roofs, and more.

Skipping this step could result in expensive surprises later. Even if the house looks perfect on the outside, hidden problems can cost thousands to fix.

Role of Appraisals

An appraisal determines the fair market value of the property. Lenders require it to ensure the loan amount matches the home’s actual worth. If the appraisal comes in lower than the offer price, renegotiation may be necessary.

Understanding both inspections and appraisals protects you from overpaying or investing in a home with costly hidden issues.

Document Signing During Closing

Relevance: Closing involves multiple legal and financial documents that finalize the transfer of ownership.

Legal and Closing Steps

Review All Documents Carefully

The closing process includes signing contracts, reviewing loan terms, and finalizing payment arrangements. It’s essential to review every document carefully to avoid errors or unfavorable clauses.

Hiring a real estate attorney, where applicable, ensures that all contracts protect your interests as a first-time buyer.

Plan for Closing Costs

Closing costs typically range from 2% to 5% of the home’s purchase price. These include fees for appraisals, title searches, attorney services, and more. First-time buyers often overlook these costs, leading to last-minute financial stress.

Factoring closing costs into your budget from the beginning avoids unpleasant surprises and ensures a smoother transaction.

Digital Budgeting App Showing Homeownership Goals

Relevance: Technology helps track expenses and set realistic savings targets for first-time buyers.

Benefits of Using Technology in the Homebuying Process

Technology simplifies nearly every stage of the homebuying journey. From mortgage calculators to digital contract signing, buyers have more tools than ever to stay organized.

Budgeting apps provide real-time visibility into spending, while real estate platforms offer detailed property insights without leaving your home. These innovations not only save time but also empower buyers with better decision-making tools.

Real-World Examples of Useful Tools and Services

Affordability Calculators

Affordability calculators give buyers instant insights into monthly mortgage payments, helping them stay within budget. These tools adjust based on income, loan terms, and interest rates.

Relevance: They prevent buyers from falling into financial traps by clarifying affordability upfront.

Credit Monitoring Services

Credit monitoring apps keep first-time buyers informed about changes in their credit score. They also suggest actionable steps to improve credit before applying for a mortgage.

Relevance: Higher credit scores mean lower interest rates, making homes more affordable long-term.

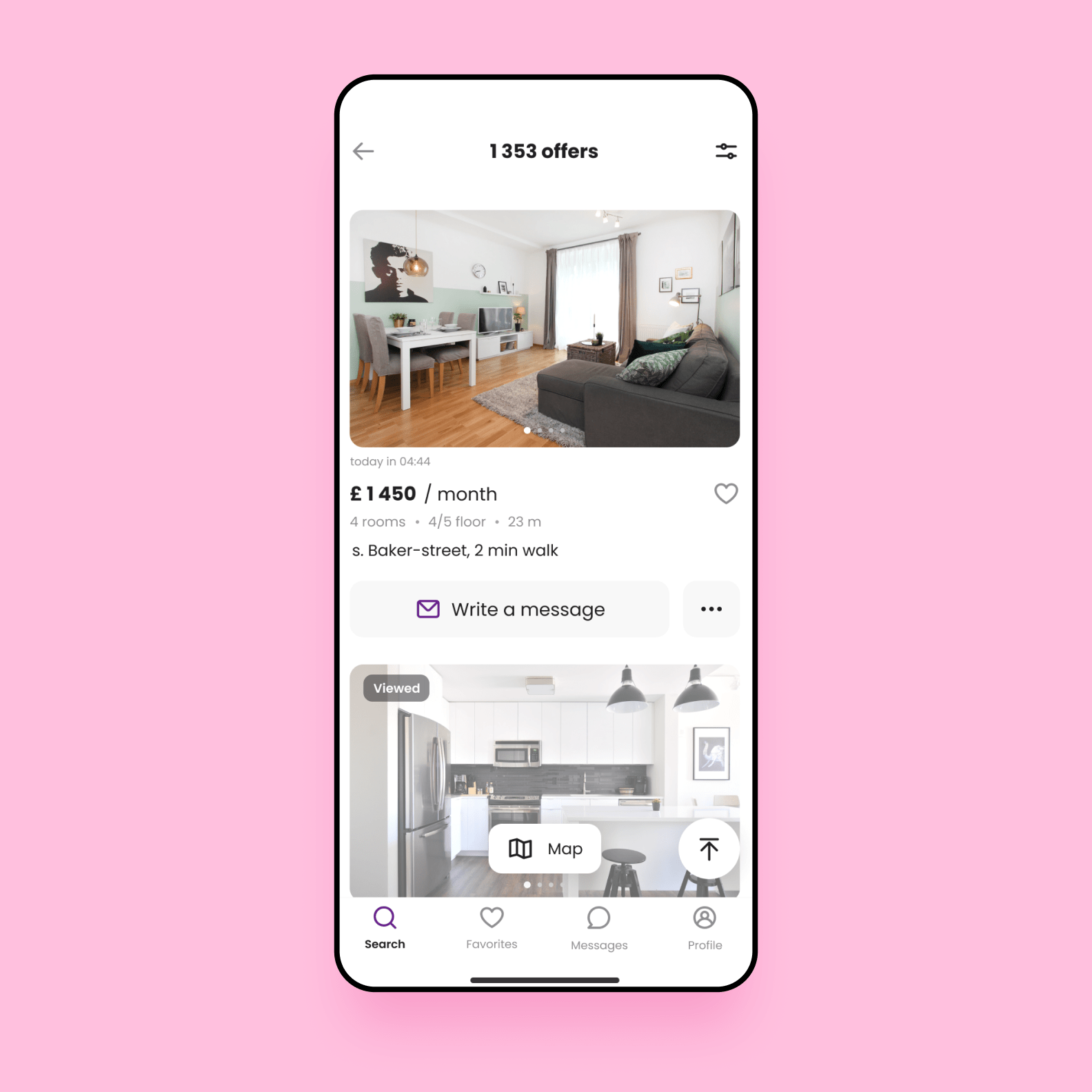

Real Estate Apps

Real estate apps allow buyers to filter homes by budget, location, and features. They also provide neighborhood data such as schools, crime rates, and amenities.

Relevance: These tools streamline the search process and ensure buyers only consider homes that fit their lifestyle.

E-Signature Platforms

During closing, e-signature services make document signing faster and more efficient. Buyers can complete legal steps from home without scheduling multiple in-person meetings.

Relevance: They save time and reduce stress during one of the busiest phases of homebuying.

Practical Use Cases of the Checklist

-

Young Couples: Can rely on digital budgeting apps to align their joint finances before applying for a loan.

-

Single Professionals: Use real estate apps to search homes in neighborhoods that fit both budget and lifestyle.

-

Families: Benefit from working with agents to prioritize schools and child-friendly amenities.

-

Low-Income Buyers: Use credit monitoring and financial planning services to improve approval odds.

Frequently Asked Questions

1. What should I do first when preparing to buy a home?

Start by reviewing your finances and savings. Establish a budget, check your credit score, and calculate how much you can afford before browsing listings.

2. How important is mortgage pre-approval?

Pre-approval is essential. It not only helps you understand your budget but also shows sellers you’re serious and financially capable.

3. What’s the most overlooked cost by first-time buyers?

Closing costs are often forgotten. They can add 2–5% of the purchase price, so planning for them early is critical.