What to Do After Buying Your First Home: Maintenance and Financial Planning Tips

What to Do After Buying Your First Home (Maintenance & Financial Planning)

Buying your first home is a major achievement, but the journey doesn’t end at closing. The real responsibility begins once you’ve received the keys. From routine maintenance to financial planning, knowing what to do after buying your first home ensures you protect your investment and build a stable foundation for the future.

This guide will take you through essential steps for new homeowners—covering home maintenance, budgeting, financial strategies, and practical tools to help you manage your new responsibilities confidently.

Securing and Inspecting Your New Home

Change the Locks and Secure Entry Points

The first step after moving in is to secure your home. Changing locks gives you peace of mind, ensuring that no one else has access. Don’t forget garage doors, windows, and any side entrances. This simple step protects both your property and your family.

Schedule a Full Home Inspection

Even if an inspection was done before purchase, it’s wise to do a walk-through with a trusted contractor or professional. Check plumbing, electrical systems, HVAC units, and roofing. Catching small issues early prevents costly repairs down the road.

Essential Home Maintenance for First-Time Owners

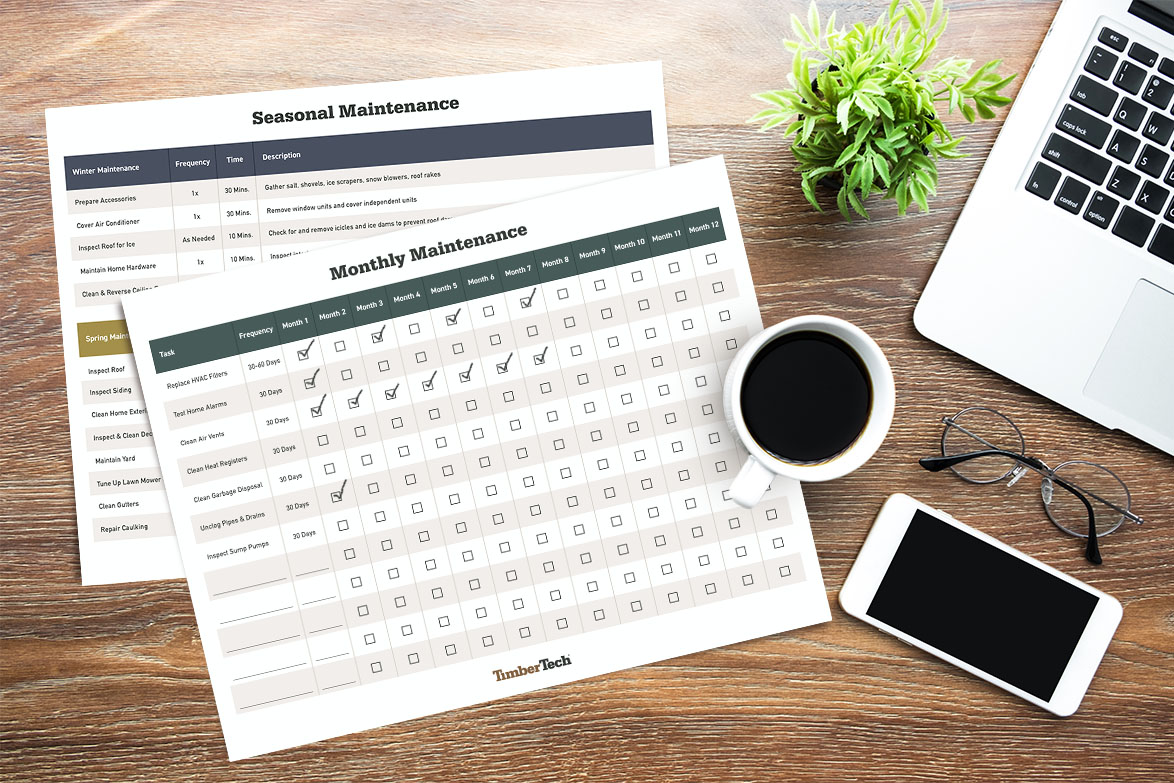

Create a Seasonal Maintenance Checklist

Every home needs seasonal care. For example, clean gutters before rainy seasons, service HVAC units before summer or winter, and check roofs for leaks annually. Building a checklist ensures no critical task is overlooked.

Learn Where Shut-Off Valves and Breakers Are

Knowing how to turn off water, gas, or electricity in an emergency is crucial. First-time homeowners should locate and label shut-off valves and circuit breakers immediately. This knowledge can save thousands in damages if a leak or electrical fault occurs.

Financial Planning After Buying Your First Home

Build a Home Emergency Fund

Unexpected expenses are part of homeownership—whether it’s a leaking pipe or a broken appliance. Experts recommend saving three to six months’ worth of expenses, with a portion dedicated specifically to home repairs.

Review Insurance Policies

Check your homeowner’s insurance to ensure adequate coverage. This includes structural protection, liability, and contents insurance. In certain areas, you may also need flood or earthquake coverage. Having the right insurance reduces financial risks dramatically.

Real-World Examples of New Homeowner Challenges

First-Time Buyer Facing Plumbing Repairs

A young professional purchased her first home only to discover frequent plumbing leaks. Because she had budgeted for an emergency fund, she was able to cover repairs without going into debt. This highlights why setting aside savings is essential after closing.

Family with Rising Utility Costs

A family of four moved into a larger home and was surprised by high monthly utility costs. They invested in a smart thermostat and improved insulation, which lowered bills significantly. Their case illustrates the importance of planning for long-term efficiency.

Retiree Managing Property Taxes

A retiree who downsized underestimated annual property tax increases. After consulting with a financial planner, he adjusted his budget and set aside monthly savings to handle the taxes comfortably. This example shows the need for proactive financial planning.

Benefits of Using Technology for Home Management

Smart Maintenance Apps

Apps like Centriq allow homeowners to track appliances, warranties, and service records. Uploading manuals and setting reminders for maintenance tasks keeps everything organized in one place.

Energy Efficiency Monitoring

Insert image of the product format: Smart Thermostat Installed in a Living Room

Devices such as smart thermostats and energy-monitoring plugs help you track and reduce consumption. Not only do they cut costs, but they also promote eco-friendly living.

Digital Financial Tools

Budgeting apps like YNAB (You Need a Budget) or Mint allow homeowners to plan for mortgage payments, repairs, and utility bills. These tools provide real-time financial insights that reduce stress and prevent overspending.

Practical Use Cases of This Checklist

-

Emergency Preparedness – Knowing where shut-off valves are can prevent thousands of dollars in water damage.

-

Budget Control – Digital budgeting apps help first-time homeowners adjust spending habits to cover new expenses like property taxes and insurance.

-

Preventive Care – Seasonal maintenance checklists help catch small issues before they become costly repairs.

-

Improved Comfort and Safety – Smart devices provide control over home environments, increasing both efficiency and security.

Why This Approach Is Useful in Real Life

For many, the transition from renting to owning is overwhelming. Renters often rely on landlords for repairs, but homeowners are fully responsible. This checklist bridges that gap by offering a clear roadmap.

It provides financial stability by encouraging emergency funds and insurance reviews, while also ensuring homes stay safe and functional through maintenance routines. For first-time homeowners, this structure prevents stress and protects long-term investments.

Frequently Asked Questions

1. What’s the first financial step after buying a home?

The most important step is creating an emergency fund specifically for home repairs and unexpected costs. This ensures you’re financially prepared for surprises that come with homeownership.

2. How often should I review my homeowner’s insurance?

At least once a year, or immediately after major renovations. Coverage should evolve with your home’s value and your personal needs.

3. Do I need to hire professionals for all maintenance tasks?

Not necessarily. Simple tasks like changing air filters or cleaning gutters can be done yourself. However, complex issues such as electrical work or roofing should be handled by licensed professionals for safety and quality assurance.